Are you a committed worker in a vital field? The path to homeownership can sometimes seem challenging, but there are unique mortgage options designed specifically for frontline heroes. These Special Sector Mortgages offer perks that can make your dream of owning a home a more attainable goal.

- Typically, Key Worker Mortgages provide favorable lending terms.

- This can reduced monthly payments over the life of your mortgage.

- Moreover, some Key Worker Mortgage schemes may feature lower down payment options, making homeownership more attainable for those who might not otherwise qualify.

Navigating Self-Employed Mortgages with CIS

Securing a mortgage as a self-employed individual can seem complex, but understanding the role of CIS (Construction Industry Scheme) can make the process significantly more manageable. The Construction Industry Scheme is designed to ensure that payments made to contractors in the construction industry are properly taxed. Lenders often require evidence of your CIS compliance as part of their review process, as it demonstrates your financial reliability.

- In order to navigate this effectively, ensure you deliver accurate and up-to-date CIS returns. This will help in showcasing a consistent income stream to lenders.

- Furthermore, maintain detailed records of your income and expenses, as this can provide valuable transparency into your financial position.

- Don't hesitate to consult a mortgage advisor specialized in dealing with self-employed mortgages. They can guide you through the process and optimize your chances of securing favorable rates.

Navigating Mortgage Calculators: Identify Your Perfect Rate

Embark on your homeownership journey with confidence by mastering the art of mortgage calculators. These essential tools empower you to analyze your monthly payments, explore different interest rates, and ultimately determine the mortgage that ideal suits your financial situation.

- Dive into factors like loan amount, duration, and interest rate to calculate precise payment estimates.

- Compare various mortgage scenarios to reveal the most favorable option for your needs.

- Gain insight into the long-term financial implications of your mortgage choice.

By leveraging the potential of mortgage calculators, you can make informed decisions and ease your path to homeownership.

Partnering for Your Homeownership Dreams

At Albion Forest Mortgages, we recognize that purchasing a home is one of the primary decisions you'll ever make. That's why our team of experienced mortgage professionals is committed to providing you with exceptional service and guidance every step of the way. We offer a diverse range of mortgage products to suit your individual needs and economic situation, ensuring you find the perfect solution for your home loan journey.

Our system is designed to be accessible, so you'll always know exactly where you stand. We take the time to explain all terms and conditions, answering any questions you may have along the way. With Albion Forest Mortgages by your side, you can peacefully navigate the mortgage process and achieve your dream of homeownership.

Find Your Dream Home: Albion Forest Mortgage Solutions

Purchasing a home is an exciting journey, and at Albion Forest Mortgage Solutions, we support you every step of the way. Our team of experienced mortgage professionals is dedicated to finding the perfect mortgage options that meet your unique needs and budget.

We understand that acquiring a home can be key worker mortgage challenging. That's why we provide transparent communication and customized service to ensure you feel confident throughout the process.

At Albion Forest Mortgage Solutions, we are committed to helping you fulfill your dream of homeownership.

Navigating the Mortgage Process: Albion Forest Expertise

Applying for a mortgage can feel overwhelming. With numerous terms, requirements, and paperwork involved, it's easy to get lost in the complexities. At Albion Forest, we understand this difficulty and are dedicated to making the mortgage process as efficient as possible for our clients. Our team of expert mortgage specialists possesses in-depth knowledge of the industry and is committed to providing personalized guidance every step of the way. We endeavor to guide you through each stage, ensuring understanding and helping you make informed decisions.

- Our team's expertise encompasses a wide range of mortgage products, allowing us to match the perfect solution to your unique needs and financial situation.

- We value open communication and are always available to respond your questions and inquiries.

- Through partnering with Albion Forest, you can securely navigate the mortgage process knowing that you have a dedicated team of professionals working diligently on your behalf.

Ben Savage Then & Now!

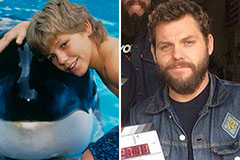

Ben Savage Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now!